Overview

With the increasing prevalence of liveability and sustainability outcomes driving strategic directions for water utilities, it is important to get a better undestanding of customers willingness to pay for these types of outcomes. Many of the projects resulting from these strategies are seeking to go beyond traditional water and sewerage service requirements to provide enhanced outcomes for customers.

As opposed to relying on highly uncertain customer willigness to pay studies, the development of an opt-in ‘liveability tariff’ could allow customers to directly express their preferences to utilities regarding liveability and sustainability initiatives. This tariff would place a premium on the standard retail prices and would result in a pool of funding available for projects with high liveability and/or sustainable benefits that go beyond regulatory requirements.

For this new pricing approach to be economically efficient, utilities would need to determine that the liveability and/or sustainability benefits arising through the projects driven by the new tariff outweigh the costs of establishing and offering the new tariff option. This Aither insights piece explores this concept in more detail.

Regulatory frameworks are evolving and placing an increased focus on involving customers in important decisions. This helps ensure that the services being offered by water utilities are more reflective of customers’ needs. However, one aspect of the service offering that has not changed is the ability to choose different tariffs. There is no choice for customers regarding different tariff options or the level of service they are being provided by their urban water utility.

At the same time, water utilities are increasingly positioning themselves as more than just suppliers of water and sewerage services. A simple review of mission statements and strategies for water utilities highlights this broader focus on sustainability, wellbeing, future generations and liveability. This has led to utilities focusing on solutions that may go beyond their regulated standards and obligations in order to meet overarching sustainability or liveability objectives (for example). This can result in the preferred option being adopted that is not necessarily the least cost solution.

Where this is the case, utilities will generally justify the selection based on the improved externalities and a view that customers want the utility to deliver these externalities.

While this approach is understandable, it is not always clear whether customers are willing to pay for improved environmental outcomes that go beyond the regulatory requirements. Given the qualitative nature of the justification that is often adopted, it can also cause issues for utilities in clearly justifying the preferred option to the economic regulator as part of any expenditure review.

A voluntary pricing option might help address these challenges. The introduction of a ‘liveability tariff’ option for customers would provide a clear signal to the utilities of customer willingness to pay for additional environmental and social outcomes. For example, this tariff could be 5 per cent higher than the standard charges, with that additional 5 per cent being re-directed to a liveability funding pool. Such a tariff would be completely optional for customers (most likely through an opt-in approach). If customers did not see the value in the initiatives being proposed, then they could choose not to adopt the new tariff.

This pool of additional revenue could be used to offset the additional costs required to achieve the greater benefits from an alternative solution. This approach would provide a clear signal to the utility of the customer base’s willingness to fund these additional benefits.

A key query for the utility in considering introducing such a tariff option is whether the cost of establishing this choice for customers (e.g. through any changes to billing systems or promotions and advertising) would outweigh the likely benefits from customers taking up the offer.

How it could work

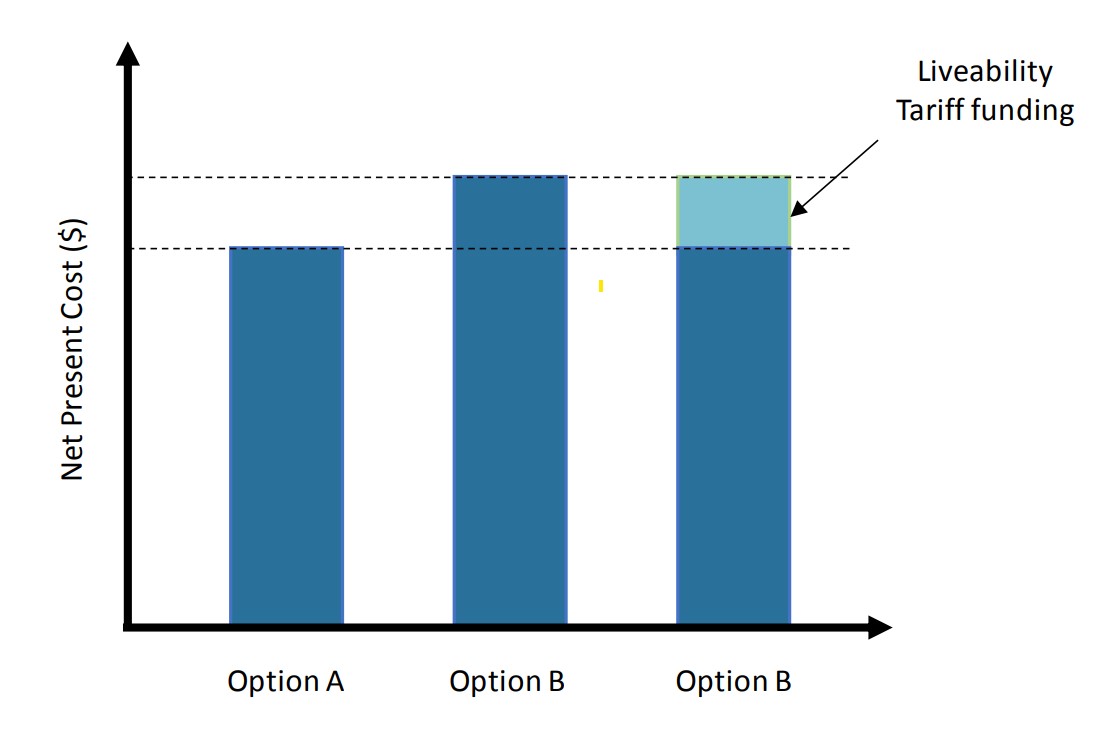

The pool of additional funds would be used to invest in options that may not be the least cost solution for the utility to meet its obligations, but may provide other benefits that make it an economically desireable investment. In the diagram to the right, the least cost option is Option A which is based on the minimum services as required under the regulatory standards (such as a wastewater treatment plant that meets regulated outflows). Option B involves additional expenditure designed to achieve additional environmental outcomes that are beyond the regulatory standards (such as diversion of outflows and nutrients through recycling, or higher treatment standards). The third column demonstrates how the funding from a liveability tariff pool would be used to achieve the desired environmental outcomes. Under this scenario, funding would be used from this pool to ensure that Option B becomes equal to the financial cost of Option A.

Each year, the water utility would seek to identify projects that have additional environmental (or liveability) outcomes and would benefit from additional funding to offset the additional cost involved.

In some cases, this may mean that only one project receives this funding, in other years it may result in multiple projects receiving funding. Ultimately however, the limit for additional expenditure related to projects that go beyond the regulatory standards would be equal to the additional funding received through the liveability tariff.

Given the optional nature of the liveability tariff, the utilities would need to be transparent about the projects that were being funded, the proposed outcomes from the projects and then the subsequent performance of these projects against the expected outcomes. Utilities would need to demonstrate the benefits arising from these projects in order for customers to continue to see benefits from the liveability tariff and attract new customers for the tariff.

Investment evaluation

A key benefit of a liveability tariff is that it overcomes the challenges of assessing community willingness to pay for non-market social and environmental outcomes. Currently, many IWM projects rely on cost-benefit analysis to determine if they are worthwhile. Aither supports CBA and the inclusion of non-market social and environmental benefits and costs in these assessments (see Valuing Environmental and Social Outcomes). However, in our experience, these assessments sometimes lack rigorous information on the links between investments and environmental and social outcomes, and uncertainty about the value of these outcomes as expressed in community willingness to pay. This approach also needs to be combined methods for allocating costs and recovering expenditure. A liveability tariff would be one option to help address these challenges. People would express their willingness to pay directly and water utilities would be collecting the funds for implementing priority initiatives. In addition to the liveability tariff option, there may be other ways of addressing this issue – including crowdsourcing / funding for projects and local initiatives – which utilities may consider feasible.

Distribution of benefits and aligning with customer value

In addition to the costs of implementing a liveability tariff, another query about the concept relates to the nature of the benefits. This is particularly evident when these projects are likely to have public good aspects of non-excludability and non-rivalry, and when the benefits are highly localised. For example, water utilities are currently considering investment in a range of water sensitive urban design and integrated water management solutions including stormwater harvesting and reuse. These projects can produce benefits for water utilities in meeting their service standards (e.g. avoided costs of other infrastructure).They also produce other benefits such as enhanced public open space and associated recreational benefits, improved waterway health, and reduced flood risk. However, these benefits typically accrue only to local residents. Additionally it is impossible to ensure that only those people who paid for the liveability tariff receive the benefits – the benefits would be received by everyone, particularly those living close to the initiative. So, would people be willing to pay for a liveability tariff if the projects delivered were on the other side of the city? Would there be an incentive to free-ride?

This demonstrates the importance of project selection for the water utility if it were to implement a liveability tariff – if the selected projects do not align with customer values, then the uptake of the tariff will be lower and therefore less funding would be available. It may also require the consideration of applying the liveability tariff on a localised, or regional, basis to target the potential beneficiaries. The utility would therefore need to understand what customers value and promote the tariff in a way that meets those values.

Considerations for utilities:

- Additional marketing and billing system costs

- Additional reporting and billing complexity

- Independent review of costs

- Process for selecting projects and exit strategies

Considerations for regulators:

- Separation of regulatory accounts and cost allocation

- Exit provisions for customers in hardship

- Ongoing operating costs for projects if tariff is discontinued

One of the key difficulties of incorporating improved liveability outcomes is the ability to accurately value the outcomes. While this potential approach is not a “silver bullet” it may help in providing further discipline for utilities in defining and delivering on those liveability outcomes. By considering an ‘opt-in’ approach, this provides customers with a degree of power of defining the level of investment in these outcomes.

Download the think piece 'Aligning liveability and customer value'