Environmental and natural resource economists are sought by governments and businesses to appraise the total economic value of an investment in natural capital. All too often, the role of economists is reduced to simply putting a dollar number in an investment proposal or business case. This is important, but often overlooks the wider range of benefits economics can offer to improve the quality of investment proposals. Economics will only be truly beneficial when combined with good sense—a principled, rigorous, evidence-based approach to investment appraisal, business case development, and adaptive management. In this article, we outline the foundations of environmental economics and how it can improve the quality of business cases for investment in natural capital.

Valuing the environment

The environment delivers a range of critical goods and services that are valuable and can be valued. However, most of these environmental goods and services, such as clean air, clean water, and biodiversity, are not traded in markets. Instead, their economic value is often reflected in the wellbeing benefits people get from recreating or visiting nature or from simply knowing that natural systems exist and are healthy.

Investment in the protection and restoration of natural capital also provides a range of ecosystem services benefits, including carbon storage, flood protection, water storage and filtration, and pollination that are fundamental to life on earth. However, the case for investment in these services is often weak. While some environmental markets exist or are being developed, the value of these ecosystem services – and how much people are willing to pay for them – is not fully revealed in market prices, which can limit investment from the government and private sector. Instead, different methodologies that reveal the non-market value of these ecosystem services are required.

Robust methods for valuing ecosystem services have been developed by economists. Using these methods enables the full range of benefits to be considered in investment decision making. The importance of economic valuation continues to grow because it is recognised that better policy and other investment decisions can be made when they account for the full range of economic, social, and environmental impacts of an investment.

Economists are often asked to undertake this valuation process. However, all too frequently they are expected to simply provide a dollar value for the investment decision making process (e.g., business cases or funding submissions). However, in practice, economists rely on a range of inputs to ensure a rigorous assessment. For example, economists rely on a clear understanding of how the action being invested in is expected to change biophysical outcomes. There is a lot more that economists can do to help improve the quality of business cases for investment. Many of these opportunities go to the integration of economics with technical assessments, stakeholder and community engagement, and principles of adaptive management. Considering the limitations and broader application of economics, outlined in more detail below, can improve the quality of investments in natural capital.

Approaching problem definition and options assessment

Investments in natural capital often have the following characteristics:

- The precise outcomes are difficult to clearly define

- They have multiple causes and interdependencies

- They are usually not stable over time

These characteristics, typical of ecological systems and processes, can present challenges for those looking to invest in natural capital. However, these issues can be managed by focusing on a few fundamental principles, including:

- Clearly understanding the problem and defining the outcomes you are trying to achieve

- Using best available science and technical assessment methods (including expert technical opinion) to assess changes in outcomes over time and under different investment options

- Identifying any co-benefits or losses associated with potential solutions

- Identifying and transparently addressing risks and uncertainty

- Actively identifying and testing critical assumptions

- Monitoring and evaluating outcomes over time

- Employing adaptive management approaches to increase investment confidence over time.

Getting these fundamentals right is critical to improving investment confidence. For economists, it is important that these fundamentals are adequately considered before thinking about valuing the investment. There’s no point trying to quantify the value of an investment in natural capital using environmental economics if there is no clarity around the biophysical changes that will be produced.

This means there is a need to link technical assessment methods and models (e.g., biophysical models) with economic models. This requires an iterative approach that often involves gaining insights from technical experts and stakeholders. Effective stakeholder engagement also offers an opportunity to help support awareness raising with key stakeholders and the community, which will support the long-term success of environmental management activities or policies. Engaging with technical experts and stakeholders in this way is important to undertaking non-market valuation methods by helping to address data limitations and testing key assumptions. Being clear and transparent on these limitations or key assumptions is critical to building trust in the analysis, adding value to a decision making process, and building investment confidence.

Valuing the costs and benefits

Environmental economists have developed a range of methodologies that can be used to value natural capital investments when the fundamentals outlined above are in place.

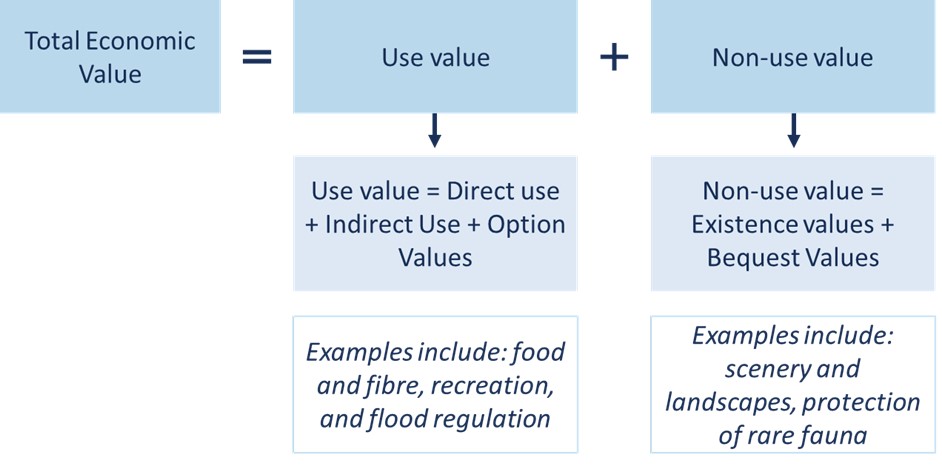

One commonly used framework is the ‘Total Economic Value’ (TEV) approach, which combines use values and non-use values to estimate the full range of values from ecosystem services. Ecosystem services contribute value to those who use the resource (use values) and non-users or passive users (non-use values). Non-use values refer to values that ecosystem services provide because they can be used by others or for the knowledge they exist. The most commonly used categories of TEV are presented in Figure 1.

Figure 1: TEV categories

Monetary values can be assigned to environmental goods and services using non-market valuation (NMV) methods. There are two broad approaches to NMV:

- Revealed preference approaches rely on observation of people’s actions in buying and selling goods and services related to the non-marketed impact under consideration. For instance, people’s preferences for housing—as reflected by the prices paid for property—can be used to infer the values they hold for environmental and social factors that affect house prices but which themselves are not marketed directly. Examples would include clean waterways that surround a property.

- Stated preference approaches involve people being asked questions in the format of a survey regarding the strength of their preferences for a specified environmental or social change.

An alternative approach to NMV is to estimate avoided costs associated with an option or options. For example, the benefits of improved water quality (reflected as a reduction in pollutant loads) can be quantified by considering the costs of an efficient alternative means of achieving the same outcome: the avoided cost to deliver similar pollution abatement.

While NMV techniques are not perfect, they are preferable to ignoring important values in economic appraisal altogether. The value that environmental economists bring to investment appraisal processes is understanding the advantages and disadvantages of different techniques, knowing which ones can be applied in different circumstances, and knowing what data is required (including the exact format of that data) to inform decision making.

There are over 5,000 published environmental valuation studies summarised in the Environmental Valuation Reference Inventory. The application of NMV methods within academia and consulting has led to a better understanding of design issues and common pitfalls and how these may be overcome. While there will always be uncertainty in the values applied to environmental goods and services, this is often not the critical issue influencing investment confidence.

Building robustness in investment proposals

In addition to using the methods describe above to value benefits, any analysis should also identify and address risks and uncertainty. This is important for environmental investments likely to be affected, for example, by climate change. For example, coral reef restoration can be at risk from bleaching events or severe storms. Understanding and identifying sources of risk and uncertainty can help develop appropriate options for investment and is important for understanding why possible interventions may or may not have achieved their outcomes when evaluating them in the future. A range of different methods are available for addressing uncertainty, from simple sensitivity or scenario analysis to complex probabilistic approaches (such as Monte Carlo methods) that can account for changes in assumptions across multiple parameters. These techniques can help ensure that investments are robust under various plausible future conditions. They can also identify critical parameters to be monitored during program or project implementation to realise benefits.

Monitoring and evaluating any programs, policies, or investments is important for ensuring better environmental investments can be made. Monitoring and evaluation are used to help understand whether the expected outcomes and benefits have been achieved and to provide insights and lessons for future policy development. Monitoring and evaluation can be used to continually assess and seek to mitigate material areas of uncertainty or risk. Environmental economics can help to identify which parameters are most important in influencing outcomes—which can be important in targeting the effort in monitoring to give greatest improvements in investment confidence.

Dollars and sense—putting it in perspective

Public and private sector owners and managers of natural capital need to build a track record of real performance to continue to attract investment. Getting this right is important to support the protection and restoration of natural capital and the delivery of ecosystem services. Quantifying the economic value of improvements in environmental outcomes can be useful and valuable in helping to attract and prioritise funding from the private and public sectors. However, an integrated and multi-disciplinary approach is needed to improve the quality of investment proposals for natural capital protection and restoration and to ensure that such investments generate improved outcomes.