Private and public investment in natural capital is needed to support life on earth

Natural capital is integral to life on earth. It supports ecosystems that provide food and water and regulate climate and disease (Figure 1). Industries, such as tourism and primary production, also depend on it. But the benefits natural capital brings to society are under threat. We urgently need options to improve and accelerate how we maintain and restore natural capital in the context of a rapidly changing climate.

Improving natural capital requires change across private and public sectors supported by strong and effective partnerships. For example, in Australia 51 per cent of land is privately managed. Investment by the private sector is needed in partnership with investment by government. However, identifying the best mechanisms to incentivise the private sector beyond their existing investments and obligations is challenging for governments.

Source Adapted from Natural Capital Protocol

Figure 1 Defining natural capital and its roles delivering critical ecosystem services and benefits to society

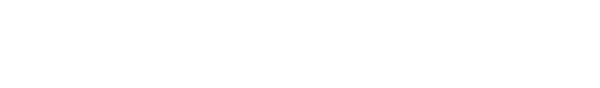

There are significant benefits and barriers to private investment in natural capital

For the private sector, investments in natural capital are an opportunity to invest with purpose, be financially rewarded and improve resilience. For governments, attracting private investment also offers significant benefits.

Attracting private investment can improve the cost-effectiveness of public funding. Private investment can facilitate the allocation of further capital – and it can more quickly bring about positive environmental and social outcomes than investment by government alone.

But investing in natural capital is complex. It can be difficult to create an environment that accommodates private investment and realises these public and private benefits (Figure 2).

Figure 2 Benefits and barriers to private sector investment

Challenges for private sector investment in natural capitalPrivate sector investment in natural capital can help achieve better social, environmental and economic outcomes. So why is it so challenging to achieve? There are many challenges to consider; however, from an economist’s perspective, the critical issue is that often the most significant benefits of investing in natural capital are public benefits. Public benefits, by definition, can be enjoyed by many different people in the community without restriction, and use by one person cannot reduce their value to others (they are non-excludable and non-rivalrous). Natural capital investment can also deliver private benefits, which have more restricted use and value (they are excludable and rivalrous). If the cost of investment, including transaction and other opportunity costs, is unlikely to outweigh the private benefit received, the private sector is not incentivised to act. However, by monetising the delivery of public benefits the private sector can be better incentivised. Mechanisms such as environmental markets, which seek to make environmental goods rivalrous and excludable, can be used to monetise environmental benefits. For example, carbon markets have successfully monetised action to reduced carbon emissions. |

There are emerging opportunities that can facilitate investment

Governments, often in partnership with the private sector, are rapidly developing policies and regulatory and incentive mechanisms to facilitate investment.

For example, Aither worked with the World Bank and project partners to develop a business case for a national strategy for coral reef restoration in Seychelles funded by public and private investment.

This work shows how the public and private sectors can share the costs, benefits and risks of investing in natural capital. In this case, businesses that rely on tourism operating in Seychelles may be willing to contribute towards coral reef restoration, recognising that a healthy reef system will attract higher levels of tourism and increase longer-term revenue.

Governments continue to identify opportunities and work on a range of mechanisms to facilitate natural capital investment. For example, the development of environmental markets in Australia has rapidly increased in recent years. The Carbon Farming Initiative is Australia’s premier example of an environmental market, with continuing improvements to methods that promote natural capital investment. State governments are also developing similar schemes, such as the Land Restoration Fund in Queensland and the Carbon Farming and Land Restoration Program in Western Australia. These schemes incentivise landholders to develop projects that improve natural capital, such as greater biodiversity and better water quality.

Supporting government identify appropriate mechanisms

There is increasing momentum to develop new mechanisms that facilitate investment. Those mechanisms with the greatest potential value need to be prioritised and developed. Any mechanisms should seek to provide additional benefits when compared with traditional funding methods, such as consolidated revenue or levies. However, identifying appropriate mechanisms is challenging.

Aither has summarised the key areas of focus governments should consider, supported by a simple roadmap, to help achieve this objective.

Be clear on the purpose of capital

The outcomes and barriers must be clearly articulated to effectively guide the identification and design of policy, regulation or other mechanisms.

There are many potential solutions that could facilitate investment in natural capital, including innovative financing options like outcomes-based impact bonds or the creation of new environmental markets. But we need to ensure these will be the most efficient and effective tools to achieve the outcomes sought.

Being clear on the purpose of the capital will encourage investments from those who are equally incentivised to deliver the same outcomes.

Policy certainty comes before investment certainty – remove disincentives for investment

The best mechanism in the world can fail if the policy environment does not accommodate, or at worst is detrimental to, the investment it seeks to facilitate. Any party seeking to invest in natural capital will want to ensure relevant regulation and policy is supportive. Conflicting regulations or policies can be a disincentive to investment – they reduce certainty and increase the investment risk.

Performance measurement is critical – but aim to keep it simple

Mechanisms to facilitate investment in natural capital rely on the measurement of performance – receiving a financial return often depends on demonstrating performance first. Measuring changes in natural capital can be complex, time consuming and expensive. A simple metric for change needs to be established and used for performance measurement. Identifying and agreeing on this metric can be challenging however the trade-off is a mechanism that is more efficient, with lower transaction costs and improved uptake.

Governance matters

Any form of investment benefits from clear governance, which drives integrity, accountability and transparency. When the return on an investment relies on defined outcomes, it is even more important. To be efficient, investments in natural capital typically rely on an agreement between the buyer and seller for an indicator for change. The governance arrangements that oversee the development of the methodology and the requirements and process to verify outcomes are critical to investment confidence by all parties.

It is about partnerships – and these have their own value

Successfully investing in natural capital requires methods and approaches that support different forms of formal contracts and informal partnerships. It is important to engage with all vested parties – including third parties – in the development, delivery and review phase of any mechanism.

Investing in partnerships is more likely to provide the best long-term solution as well as build trust and momentum towards wider behaviour change.

It is still investing – ROI matters

There are many innovative mechanisms being developed globally. Their success will depend on the private sector seeing the opportunity for a return on investment. As part of any development criteria, governments must seek to minimise barriers for entry and lower transaction costs for participation. And ultimately, they must present a compelling case for investment based on individual investment return and risk preferences.

A roadmap forward

Governments are likely to benefit from, and have a significant role to play in, facilitating investment from the private sector in natural capital. Identifying the most appropriate mechanism should be driven by outcomes with a clear business case that weighs up the benefits and costs of different options.

Figure 3 outlines a roadmap that can be used to help identify, develop and maintain mechanisms that support private sector investment in natural capital. This approach will support governments to be better placed to create a policy environment that accommodates and provides confidence to invest.

Figure 3 A roadmap for governments to investigate benefits, barriers and options to achieve improved natural capital investment

Investment in natural capital webinar