Quantifying the costs and benefits of investments and policies on environmental and social outcomes is critical for better investment decision-making

The environment delivers a range of critical services that are valuable and can be valued. However, most environmental goods and services, such as clean air, clean water, and biodiversity are not traded in markets. The economic value of these environmental services – how much people are willing to pay for them – is generally not fully revealed in market prices.

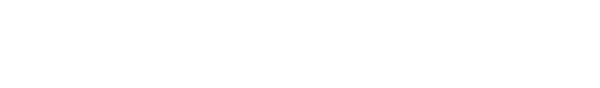

Ecosystem services contribute value to those who use the resource (use values), but also to non-users or passive users (non-use values). Non-use values refer to values that ecosystem services provide for the mere reason that they can be used by others or for the knowledge that they exist. The combination of use values and non-use values is often referred to as the ‘Total Economic Value’ (TEV) or Triple Bottom Line (TBL). The most commonly used categories of TEV are presented in Figure 1.

Figure 1: Total economic value categories

Because they may not be readily revealed in market prices, the value of environmental services can be neglected in decision-making. Economic appraisal tools such as Cost Benefit Analysis (CBA) are commonplace in government investment decision-making processes. One of the many advantages of CBA is that different types of benefits and costs can be compared using a common monetary metric. However, in some cases CBA may be undermined by not quantifying, in monetary terms, the costs and benefits of projects or policies on environmental and social outcomes.

Where environmental and social values are not considered in a decision-making process, there is a risk that an option that delivers the greatest net economic benefit is not identified. Failure to quantify all the key costs and benefits associated with any particular investment option risks making a decision with incomplete information. One option for assigning monetary values to environmental goods and services is to use non-market valuation (NMV) methods.

Non-market valuation techniques can play an important role in improving decision making. Particularly in instances where there may be substantial social and environmental impacts, non-market valuation can ensure that decisions are made based on an understanding of the total economic value (often referred to as the TBL comprising social, environmental and economic costs and benefits).

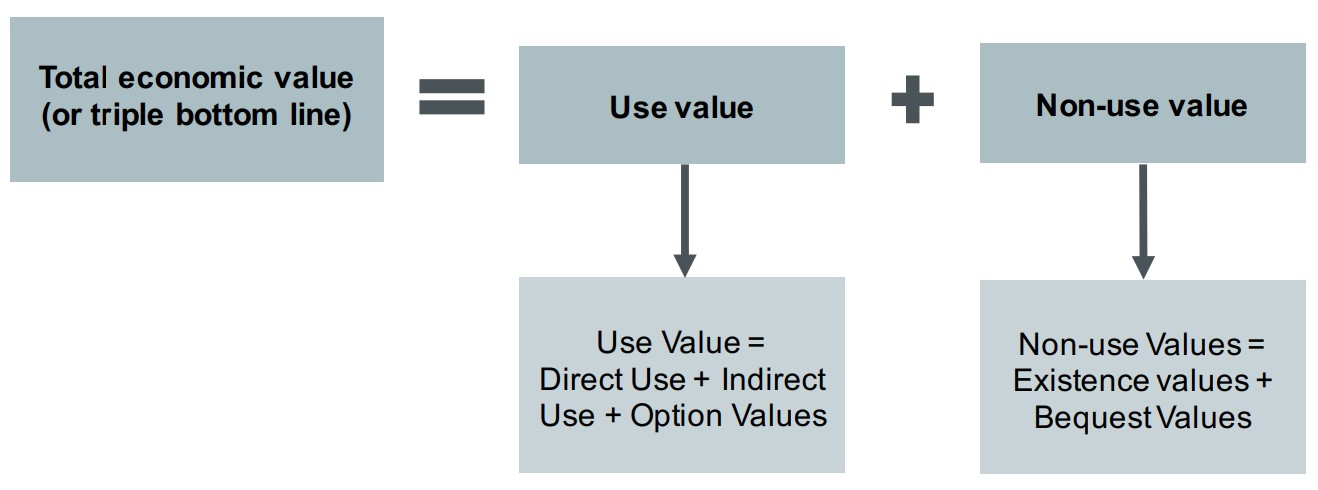

There are two broad approaches to non-market valuation:

- Revealed preference approaches rely on observations of people’s actions in buying and selling goods and services that are related to the non-marketed impact under consideration. For instance, people’s preferences for housing – as reflected by the prices paid for property – can be used to infer the values they hold for environmental and social factors that affect house prices but which themselves are not marketed directly. Examples would include clean waterways that surround a property.

- An alternative approach to non-market valuation is to estimate avoided costs associated with an option or options. For example, the benefits of improved water quality (reflected as a reduction in pollutant loads) can be quantified by considering the costs of an efficient alternative means of achieving the same outcome; in other words, the avoided cost to deliver similar pollution abatement.

- Stated preference approaches involve people being asked questions in the format of a survey regarding the strength of their preferences for a specified environmental or social change.

The various approaches for economic valuation are presented in Figure 2.

Figure 2: Different approaches to economic valuation

While non-market valuation techniques are not perfect, they are preferable to ignoring important values altogether in economic appraisal. There are over 4,500 published environmental valuation studies listed in the Environmental Valuation Reference Inventory. The extensive application of non-market valuation methods has led to a better understanding of design issues and common pitfalls, and how these may be overcome. Understanding and articulating the limitations of non-market valuation approaches is important for non-market valuation to best contribute to the decision-making process.

The non-market valuation approach selected should align with the type and importance of the non-market benefits or costs being quantified. For example, non-use values are best estimated through stated preference approaches while use values are frequently best estimated through revealed preference approaches.

Benefit transfer can be applied to give a sense of the magnitude of costs and benefits. Benefit transfer approaches, which draw on existing non-market valuation studies to estimate non-market values, can be a cost-effective alternative to undertaking primary data collection and analysis. However, care needs to be taken in the application of benefit transfer.

Uncertainty can be managed effectively as part of CBA by undertaking sensitivity analysis. For example, non-market valuation may result in a range of values. The upper and lower bounds of that range can be included in the CBA as sensitivity tests.

At Aither, we are highly experienced in applying non-market valuation techniques. We have used these techniques to inform decision-making as part of broader cost-benefit analysis for a range of government clients and would be happy to discuss your valuation challenges and suggest tailored and effective approaches.

Download the think piece 'Valuing environmental and social outcomes'